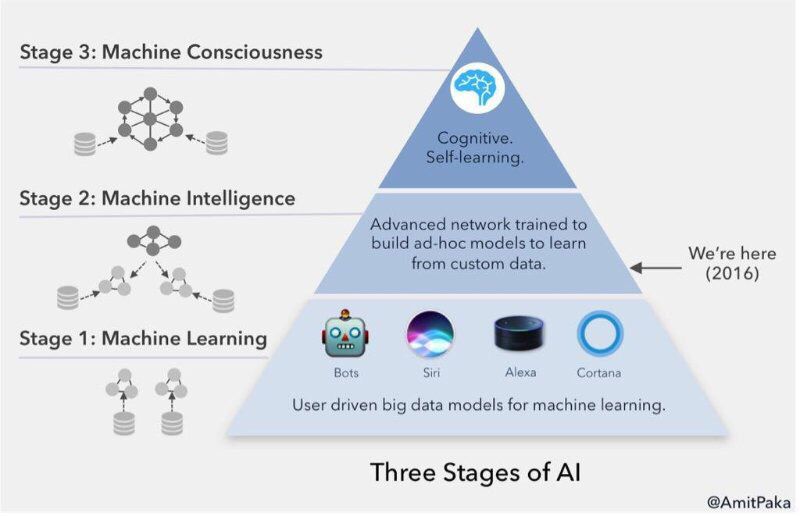

How marketers can help their clients understand AI

December 13, 2017

Supply Chain Marketing 2.0: Savvy Ways to Stand Out

March 23, 2018

Corporate Ink discusses recent news stories that demonstrate how the supply chain can differentiate businesses and even transform industries.

We live in an era of digital transformation and, as a result, industries across the globe are facing significant disruptions driven by technologies like AI, machine learning and blockchain. While this is an uncertain time for many organizations, the new landscape comes with tremendous potential for innovation and change. Organizations that want to not only survive, but thrive, must adapt and develop new strategies for staying ahead.

One key – and often overlooked – lever for competitive advantage: the supply chain. Supply chain elements like increased speed to market, cutting costs and finding the right talent to manage the supply chain all help to move a business into tomorrow. We’ve seen several high-profile companies use smart value chain strategies to support organizational initiatives and drive industry change. Consider the following recent news stories that underscore how the supply chain can differentiate businesses and transform even the toughest industries:

As Whole Foods merges with Amazon, local suppliers watch and worry – CNN Money

Last year, Amazon sent shock waves through the retail industry when it announced its purchase of Whole Foods Market for $13.7 billion. The disruption encouraged many organizations to digitally transform their procurement processes in an effort stay competitive in the market, investing in technology Amazon already pioneered or mastered, including artificial intelligence-enabled ordering, automatic replenishment and improved inventory tracking. Retailers, constantly looking for new ways to control costs and increase efficiencies across all areas of the business, leaned on supply chain strategy to compete with Amazon on price and customer service.

Now, we are seeing changes within Whole Foods’ supplier base due to the acquisition, particularly with small, local suppliers. Presumably to cut costs and streamline processes nationwide, Whole Foods began centralizing its purchasing system and condensing some of its offerings. While this move hurts Whole Foods’ smaller suppliers, it offers other grocers like Wegmans, Stop & Shop and Star Market an opportunity to work with these local farmers and businesses, creating a competitive advantage that also encourages a shift to supporting local suppliers.

Amazon, Berkshire Hathaway and JPMorgan Team Up to Try to Disrupt Health Care – The New York Times

Amazon’s deal with Whole Foods is just the tip of the iceberg when it comes to the disruption we’ve seen from the retail giant. In January, Amazon shocked the healthcare industry when it announced its partnership with Berkshire Hathaway and JPMorgan Chase. Spurred from a conversation that took place among Jeff Bezos, Warren Buffet and Jamie Dimon about the difficulties they’ve experienced providing insurance to their employees, the partnership was created with the goal of cutting healthcare costs and improving services for the companies’ U.S. employees. Although the deal is designed to benefit only the companies’ employees for now, experts predict the impact will eventually extend to the entire healthcare sector, in a similar fashion to how Amazon disrupted the retail industry.

Following the announcement of this partnership, shares of healthcare companies like UnitedHealth Group and Anthem plummeted, signaling that changes are on the horizon for any company attempting to stay competitive in the new landscape. We are likely to see companies refine procurement strategies and reinvent supply chains by maximizing savings from healthcare souring, managing spend better and increasing visibility, control and efficiency throughout the value chain. Not only will these strategies give companies an edge in keeping up with Amazon, they will also drive global healthcare change, lowering costs for the end user and providing a transparent view of the healthcare system.

Does Wall Street Finally Care About Sustainability? – Harvard Business Review

Sustainability has been a hot topic for years, but how many companies are truly implementing responsible business practices? That’s a question that has been top of mind for a while. In BlackRock CEO Larry Fink’s annual letter to S&P 500 CEOs, he made statements in support of both long-term value creation and corporate purpose. He said, “Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.”

This is big news, especially coming from the world’s largest asset owner. Many industry experts took Flink’s comments as a message to organizations to either contribute to society or risk losing BlackRock’s support.

In a similar vein, Humanity United recently partnered with major corporations – including Disney and Walmart – and the British government to develop Working Capital, a new fund for technology investments that will ensure companies’ supply chains are free from modern slavery. This development shows corporate giants are getting serious about sustainability and investing in tools that offer the level of visibility required to mitigate CSR risks and protect both their business and those working within the value chain.

Procurement plays a critical role in helping organizations be sustainable – the supply chain represents a company’s global footprint and, as such, the practices and policies implemented with these operations can have a big positive or negative impact. When implemented correctly, the benefits of sustainable procurement extend well beyond corporate social responsibility (CSR) to mitigate supply risk, improve brand reputation and directly impact the bottom line.

For more information read these related blogs:

- Local sourcing: An asset or a liability?

- Modern Supply Chains: Four Ways Millennials Have Changed Everything

- Achieving sustainability in the supply chain (Podcast)